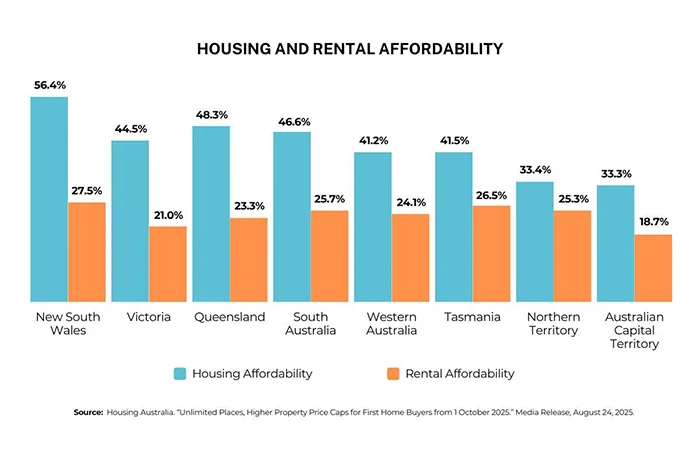

Housing affordability has improved for the second consecutive quarter, after hitting a record low at the end of 2024.

The average loan repayment in the June quarter was 47.7% of the median family income, down 0.3 percentage points from the March quarter and 0.5 percentage points from June 2024, according to the Real Estate Institute of Australia.

Affordability improved on a quarter-by-quarter basis in every state and territory except Western Australia. Rental affordability also improved slightly, falling 0.1 percentage points to 24.4% of median income.

One way for first home buyers to take advantage of these improving conditions is to use the federal government’s expanded Home Guarantee Scheme. From 1 October 2025, all first home buyers have the chance to enter the market with just a 5% deposit and without having to pay Lenders’ Mortgage Insurance. The property price caps will be increased, while the income caps will be removed.

Contact us if you’d like to explore whether you qualify for the Home Guarantee Scheme and how it could help you enter the market sooner.