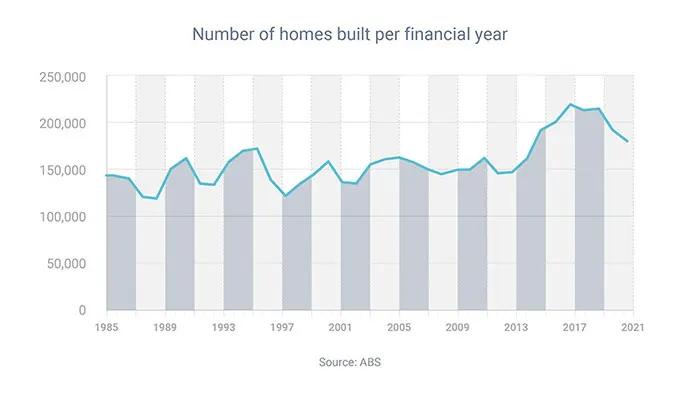

Australians built 1.02 million homes between the 2016 and 2021 financial years - a big increase on the long-term average, which has typically involved about 750,000 dwelling completions during each five-year period.

Over the past 12 months, 231,816 residential building approvals have been issued, suggesting that lots of new homes are in the pipeline. That being said, not everyone who gets an approval ultimately goes ahead with the project.

Low interest rates and government incentives are two big reasons for the recent building boom.

Construction loans are similar to regular home loans in some ways – interest rates are comparable, and you can choose between variable and fixed. However, where they differ is in how the lender delivers the money to the borrower.

With construction loans, the lender provides your loan in stages or 'drawdowns', as the different stages of your building contract are completed. The lender charges you interest only on the funds it has provided, not the full amount: so if your total loan is for $500,000 but you’ve received only $100,000 of drawdowns, you’ll only be charged interest on the $100,000, not the full $500,000.