5/11/2024

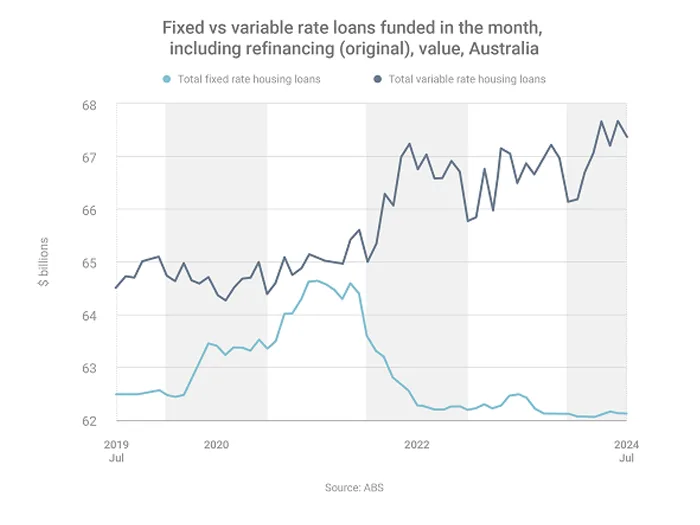

The vast majority of home loan customers are currently choosing variable-rate loans over fixed-rate loans.

In August 2024, 98% of new loans were variable, while only 2% were fixed, according to the most recent data from the ABS.

By comparison, in August 2021, when interest rates were at record-low levels, 46% of borrowers decided to fix, while 54% went variable.

Interest rate expectations appear to be guiding borrowers’ decisions.

In 2021, when rates were at ultra-low levels due to the pandemic, most borrowers assumed they would rise sooner or later – so many chose to lock in those lower rates.

Today, most borrowers assume rates have peaked, so they want a variable loan that will get cheaper if and when the Reserve Bank of Australia starts reducing the cash rate.