With property prices at record levels, the size of the average mortgage has also hit new highs, making it more important than ever that you shop around for the right loan.

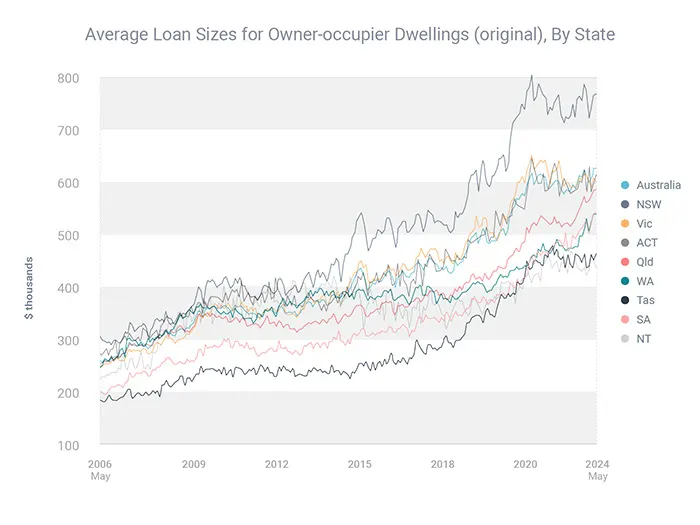

Australia’s median property price reached a record $794,000 in June, up 8.0% year on year, according to CoreLogic. Meanwhile, the size of the average owner-occupied loan reached a record $626,055 at the end of May (the most recent month for which we have data), which is up 7.1% year on year, according to the Australian Bureau of Statistics.

Just as interest rates can vary significantly from lender to lender, so can your borrowing power, depending on your financial profile, the type of property you’re planning to buy and the location of the property. Sometimes, one institution might be willing to lend you tens of thousands – or even hundreds of thousands – of dollars more than another institution.

Trying to source all this information yourself would be very time-consuming. But mortgage brokers like myself have an intimate understanding of the credit policies of many different lenders. That’s why, if you get a home loan through a broker, we can recommend a lender that is suitable for someone with your profile and scenario.