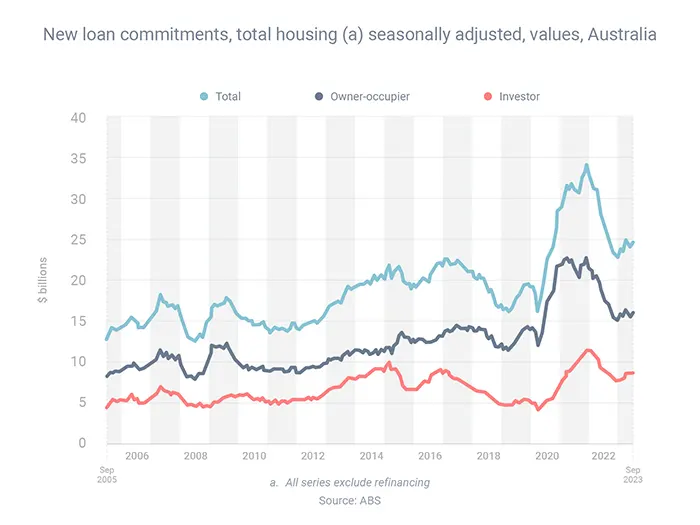

There has been a big rise in home loan activity over the course of the year, with investors leading the way.

Between February and September, the total volume of mortgage commitments rose 9.5% to $25.0 billion, according to the latest data from the Australian Bureau of Statistics.

Owner-occupied borrowing climbed 6.1% to $16.1 billion, while investor borrowing jumped 16.0% to $9.0 billion.

Three other key facts:

I love helping all kinds of borrowers, from first home buyers and investors to renovators and refinancers. Please reach out if you need assistance!